What is technical analysis and how does it work?

Once you have a ESKIMO account, you instantly gain access to over fifty markets across thirty countries at the push of a button. What to do next is the big question. Many people already know what they want to invest in. Others want to spend some time researching where they want to put their money.

When it comes to picking stocks, there are two schools of thought on how to go about things: technical and fundamental analyses. In this article, we will explain technical analysis and show you how to get started with some of the more advanced tools available on your ESKIMO account. Read our article about fundamental analysis here.

Technical analysis of stocks

Technical analysis does not answer the question ‘what to buy’, but ‘when to buy’. It turns to statistical analysis to use trade information.

Proponents of technical analysis are not trying to find out if a stock is over or undervalued, rather if the stock can be expected to rise or fall in price based on the previous trading history in relation to previous patterns of its price movements.

Chart patterns

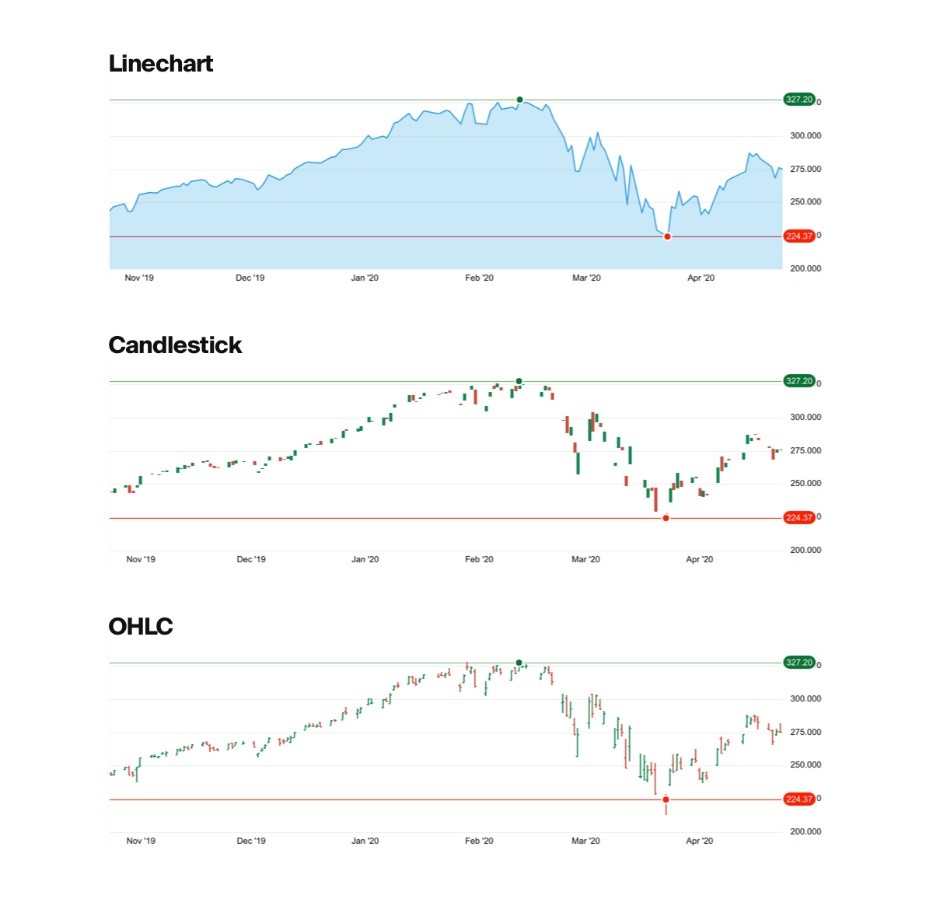

Your ESKIMO trading platform gives you a wide range of options to customise the graphs of your investments. These include the option to change the date range the interval which results are reported, and the type of chart type. By default, you will see the simple line chart (top on Figure X), but you can also change to a candlestick chart or OHLC (open-high-low-close), which give a bit more information than simply the last price of each trading day.

Additionally, with colour-coding, you will see the positive price run in green and a negative price run in red, which helps to distinguish trends. On top of these graphs, you can also overlay an index, like the EURO STOXX 50 or the S&P 500, to compare whether the stock you are looking at has beaten the relevant benchmark.

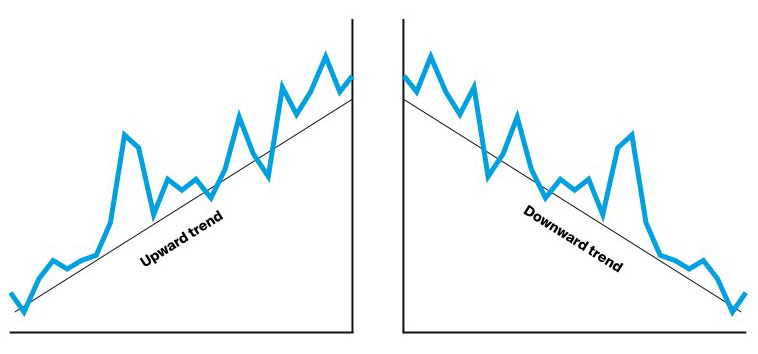

The first thing to do when getting started with technical analysis is to learn some of the patterns that you will commonly see when looking at stock graphs. These general directional movements are called trends and learning the basics is key to start with technical analysis.

The upward trend is simple enough to identify. As is the downward trend. If you analyse any stock for a long enough time frame it is almost certain that you will see both of these trends, at least for some period of time.

Moving into more complicated patterns, we can discuss what happens when an upward trend becomes a downward trend. This is known as a reversal. Sometimes this will happen quite suddenly, forming a V shape. Other times the move can be gradual.

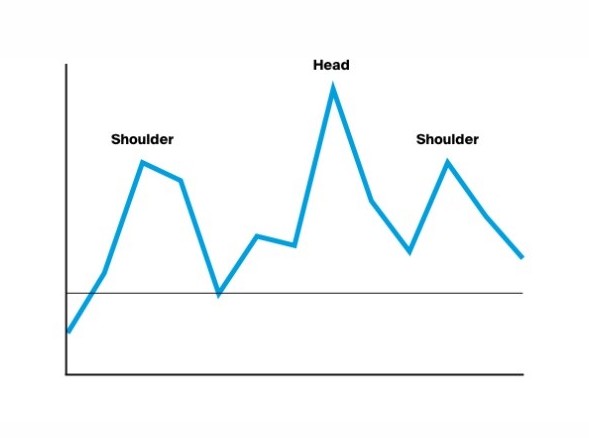

Stock trends often move around two levels: support and resistance. As the names imply, the support is a price that the stock price struggles to fall below. Likewise, the resistance level is the price at which the stock has trouble breaking past.

One of the most well-known patterns seen in markets is the head and shoulders pattern. In this pattern, the head represents the resistance level that the stock price is struggling to surpass while the neckline (the trough between the base of the shoulders and head meet) represents the support level, as this acts to keep the stock price above a certain level even following a downtrend.

Technical analysis indicators

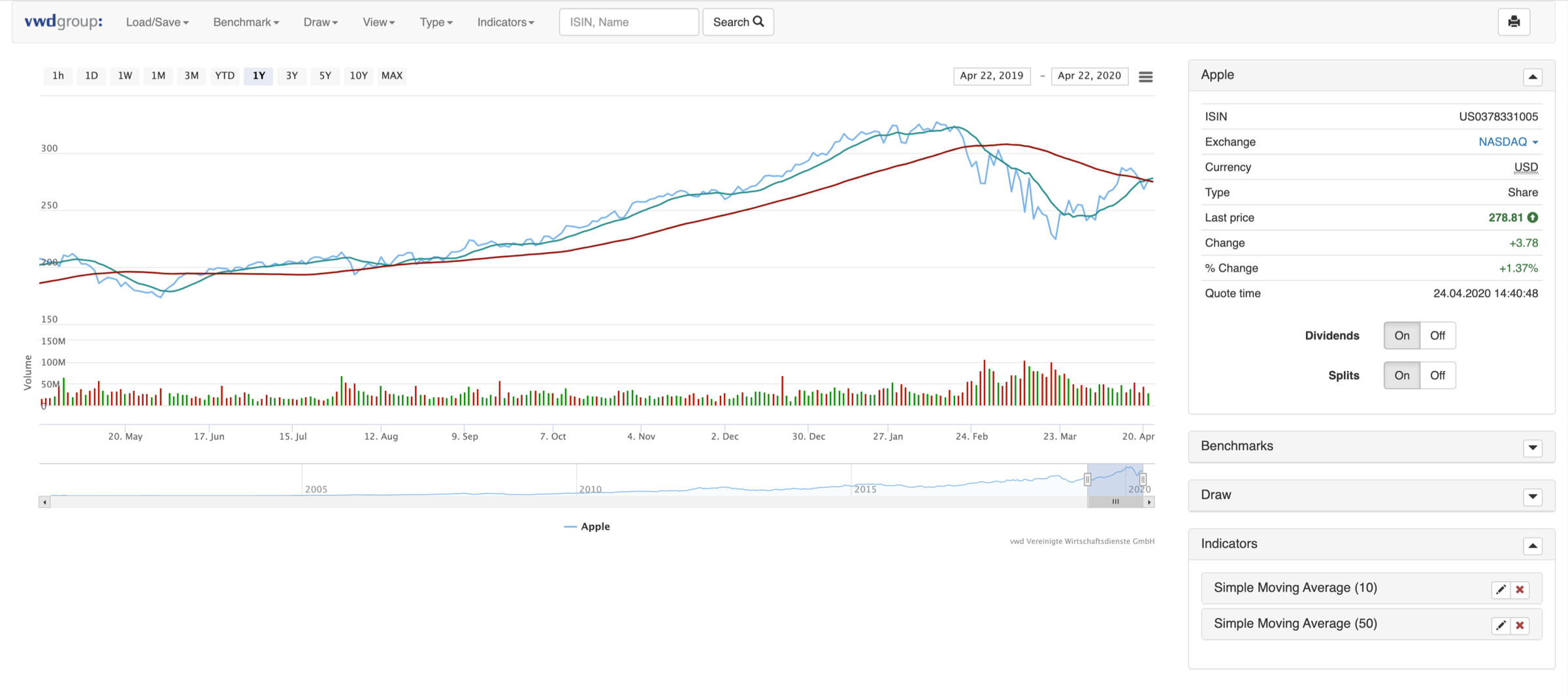

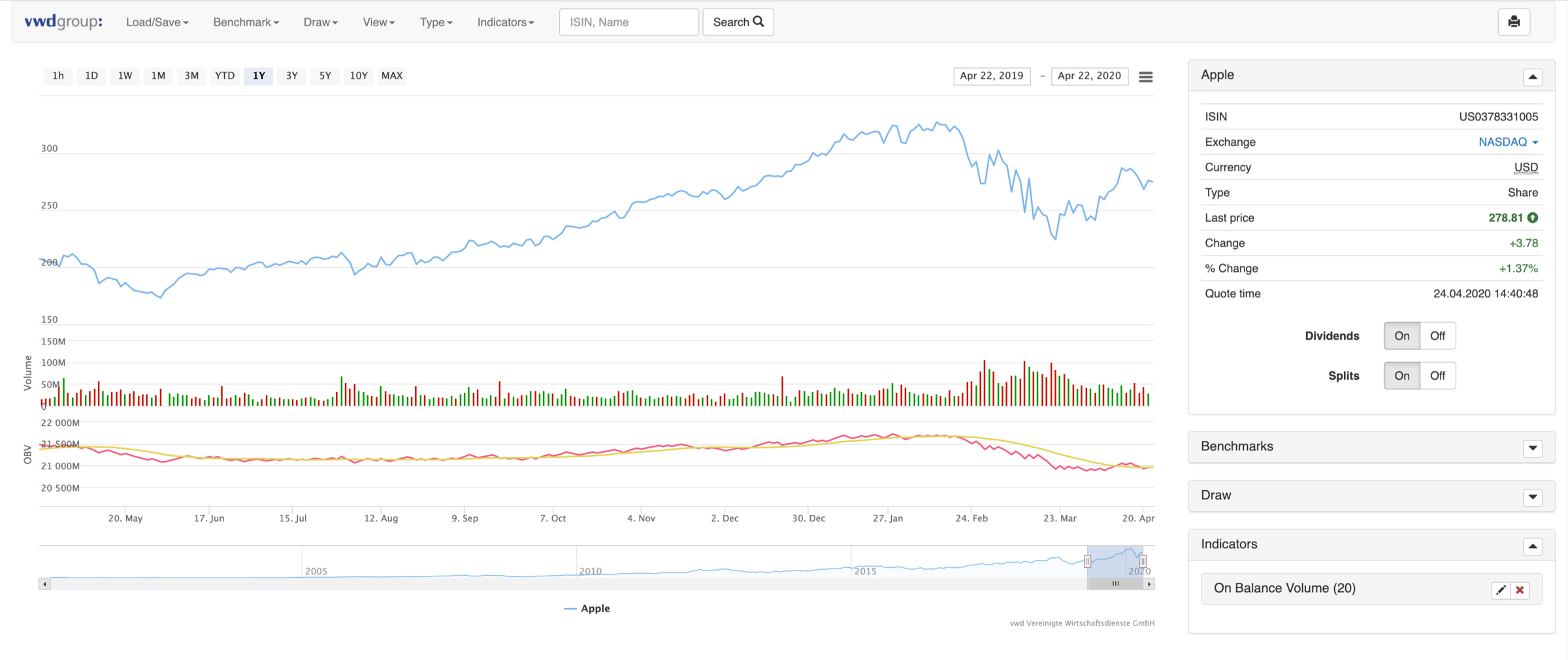

A ESKIMO trading account also gives you access to a number of different indicators to add to the product graphs. On the product page, you can click on the interactive graph button and a new window will open.

The first things you will see are the stock price graph on top and the volume on the bottom. The volume is the number of shares traded on a given day. Volume is typically displayed as a series of vertical bar charts where a higher bar chart means that more shares were traded on a given day. While most investors will always be very conscious of the price of their investments, it is vital when performing any sort of technical analysis to take into account the volume of the instrument.

Some additional options let you mark the days the company issued a dividend or a stock split, but the primary focus for those looking to focus on the technical factors is the selection of indicators.

While there are more than twenty to choose from, we will look at some of the more commonly used indicators in this article. This list is by no means a comprehensive list.

What are moving averages?

Perhaps the most commonly used technical indicator is moving averages. Moving averages are weighted averages used to estimate the current direction of a trend. Using an average value weighted over a period of time helps smooth out the day to day fluctuations and give a clearer indication of the overall trend. In the trading platform, you can set a moving average with a set period length (n).

In the above graph, you can see a simple moving average for a ten-day moving average (in green) as well as a fifty-day moving average (in red). Compared to the day-to-day movements of the stock (which you can think of as the average with a period length of one), you see the longer the set time frame, the smoother the trend line.

Trend indicators

As the name sounds, trend indicators attempt to show at what point a new trend starts. A popular trend indicator is the Moving Average Convergence/Divergence (MACD). The indicator is composed of a short term and a long term moving average. When the short term average is above the long term average, this signals positive momentum while periods when the long term average exceeds the short term, signal downward momentum.

The MACD signals a change in trend direction and the start of a new trend. The MACD is measured on a scale of one-to-one, where MACD higher than zero signals a buy and MACD lower than zero signals a sell.

Volume indicators

The last type of indicator you will find are volume indicators. In addition to the volume bar graph that is displayed on the tool, these indicators can help to make sense of how the volume of shares trading can determine the strength of a price trend.

One such example is the On Balance Volume (OBV). This is the cumulative total of buy and sell volume. A series of peaks and troughs indicates a stronger trend while a flat OBV indicates a lack of trend. The Money Flow Index uses an estimated “typical price” (an average of the high, low and close price) along with volume numbers to estimate if a security is being overbought or oversold.

How reliable is technical analysis?

For those starting with technical analysis, you will quickly realise that these indicators are both extraordinarily customisable as well as open to interpretation. As such, it is a good idea to experiment with a number of strategies and use the indicators in combination with one another to yield meaningful results when trading. At ESKIMO, we are open and transparent about the risks that come with investing.

Before you start to invest, there are a number of factors to consider. It helps to think about how much risk you are willing to take and which products match your knowledge. Additionally, it is not advisable to invest using money that you may need in the short term or to enter into positions which could cause financial difficulties. It all starts with thinking about what kind of investor you want to be. You can read more about the risks of investing in our Investors Services Information documents or our dedicated risk page.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products that match your knowledge and experience.

Start investing today.

Start investing today.

- Incredibly low fees.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.