What are bonds?

A bond is a financial product that allows an investor to lend money to an issuing entity. In return for owning a bond, lenders are paid interest, also called the coupon rate. Simply said, it is a form of borrowing. The buyer of a bond is by definition the lender, whereas the issuer is the borrower. Issuing bonds is a way in which entities can finance themselves. The money a company receives from issued bonds is seen as a loan. In general, it must be refunded over time on a date that is agreed upon beforehand. Until that date, the bondholder (lender) receives interest payments. Issuing entities can be corporations, cities or even national governments.

What should you know about bonds?

There are three key elements of a bond that are important to understand: coupon, par value and maturity date.

Coupon:

The coupon (or coupon rate) is the interest rate that is paid by a bond’s issuer. For instance, a $1,000 bond with a 5% annual coupon will pay $50 a year. The word coupon originates from a time when bonds had a paper coupon attached to them, which could be converted for the payment.Par (face) value:

The par value is the nominal value of a bond. It is also commonly referred to as the face value. This is the amount paid to the bondholder when it matures. If the interest rate rises higher than the coupon rate, then the bond will trade below par. When the rate falls below the coupon rate, it will trade at a premium, or above par.Maturity date:

This is the agreed-upon date on which the bond has to be refunded. Bonds are typically seen as low-risk products. The interest payments and maturity dates are set in advance, allowing it to become a stable and predictable source of income. The exceptions to this are when the bond is not kept until maturity or when the issuing party declares bankruptcy.Who issues bonds?

Although there are several entities that can issue bonds, there is a general distinction made between two types of issuers:

-

Government bonds

Governments commonly use bonds in order to generate money to fund expenses such as roads, schools, bridges or other infrastructure. For certain countries, the expense of a (unpredicted) war may also demand the need to raise funds. Bonds often have maturities of ten years or longer and are considered to be long term investments.

-

Corporate bonds

Corporate bonds are issued by companies to help them grow their businesses. By issuing these, companies can buy property and equipment and undertake profitable projects. The extra income may also be used for research and development or to hire employees. Companies may need more money than the average bank can provide. Bonds can solve this problem by allowing many individual investors to lend out money. Corporate debt can range from extremely safe to super risky.

Four different types of bonds

Aside from the various issuers, there are different types of bonds depending on their characteristics. Four common types are:

-

Perpetual bonds

These bonds do not have a fixed end date and have the potential to never be repaid.

-

Convertible bonds

Under certain conditions, these can be converted into shares of the company.

-

Floating rate note

These bonds have a variable interest rate.

-

Subordinated bonds

In case the issuing entity goes bankrupt, these bonds are repaid only after all the other outstanding ones are repaid. Because of this, the risks and returns are relatively high.

How to buy bonds

The most common way to buy bonds is through a broker. Commissions for the purchase vary from broker to broker. With Moonie Trade, you can buy government and corporate bonds online on a large number of exchanges. The transaction fee depends on the bond market. In contrast to other financial instruments, bonds are not priced in currency but as a percentage of the par value. This makes it easier to calculate the effective interest rate.

What determines the price of a bond?

Bonds that you own can be traded. Despite the fact that the coupon rate and par value are constant, the value of it can still fluctuate depending on multiple factors.

First, bonds are counter-cyclical, which can impact their value. When the stock market is doing well, bonds are often of less interest to investors because other financial instruments, such as stocks, seem more profitable. This causes the value of a bond to drop. In this case, issuing parties must promise higher interest payments to keep the bond attractive to invest in.

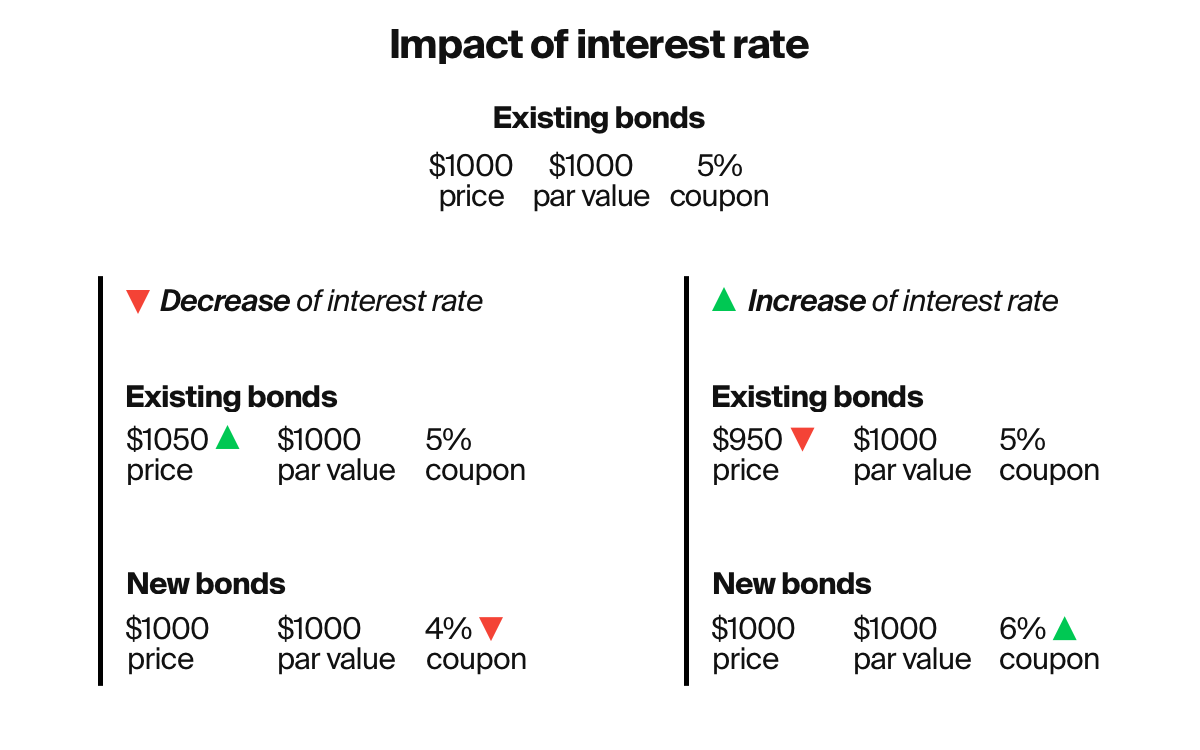

A second factor determining the price of a bond is the interest rate policy. If a central bank keeps interest rates low and is expected to do so for the full life of a bond, alternative investment options might be more attractive to investors. This can cause bondholders to sell the bond, which will lower the price. Generally speaking, the value of a bond moves in the opposite direction as the interest rate. For example, if the interest rate rises, the value of the bond will decrease.

Potential risk affects the price as well. When shareholders think that there is an increase in risk, the price of a bond can fall. As the risk increases, investors want more compensation.

Duration is another factor determining the price of a bond. Bonds with a longer duration, for example, ten years, pay more than those with a shorter duration, such as one year. The reason is that lenders are being paid for investing their money for a longer period of time. Long term bonds are likely to have a higher coupon rate than short term ones. Time until maturity can also influence the value of a bond. Here, the closer it gets to maturity, the more the price approaches face value.

The advantages of bonds

The most apparent advantage of a bond is the fact that it is a relatively safe investment. If you keep it until the maturity date, the par value will be returned unless the entity defaults.

Bonds can be profitable in two ways. First, if you own the bond until the maturity date, you will receive the par value. Before that date, you will receive interest payments (the coupon). Secondly, you can benefit by selling your bond at a higher price than you bought it.

Risks of bonds

Investing can be rewarding but it is not without risk. At Moonie Trade, we are open and transparent about the risks that come with investing. Before you start to invest, there are a number of factors to consider. It helps to think about the risk level that you are willing to take and what type of products are best suited to reach your goals. Even though the maturity date of a bond is set beforehand, there is always a chance the issuing party can default. That is why bonds are often rewarded with a risk rating by independent credit rating agencies, such as Moody’s and Standard & Poor’s.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Please be aware that facts may have changed since the article was originally written. Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products that match your knowledge and experience.

Start investing today.

Start investing today.

- Fast & Easy.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.