07 Order types

Text version

Choosing an order type

Once you know what you want to invest in, the next step is to place the order. You may be surprised to see that there are more options than simply buy or sell. Instead, you can choose from different order types that aim to give you more control while making trades. But how exactly does this work, and what are the different kinds of order types available?

Limit order

The most frequently used order is a Limit order. With this order type, you submit the quantity of stocks you want to buy or sell, and the maximum price at which you are willing to carry out the trade. Suppose you want to buy 100 stocks of company ABC. The price at the time is £35 per stock but you are only willing to pay a maximum of £33. In this case, you can place a Limit order for 100 stocks at a price of £33 per stock. If the stock price falls to £33 or below, your order will be eligible for execution at the best available price.

So, the main advantage of limit orders is that you always know what the maximum price would be if you are looking to make a purchase. However, it can also be the case that the price never hits £33. Therefore, if you try to make a purchase with a very low limit order, it can take a very long time, or might not be executed at all. The closer you place the order to the current price, the more likely it will be to receive a faster execution.

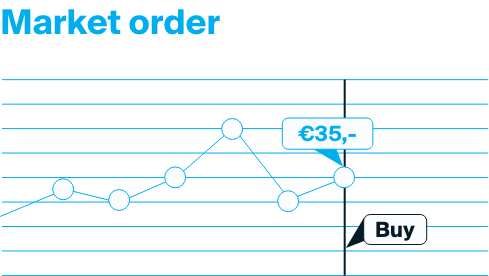

Market order

But there are also more advanced order types, such as the Market order. With this order type, you submit only the quantity of stocks to be bought or sold. You do not enter a price but rather the order will be executed at the best available price at that time. Say you place a market order to buy 100 stocks of company ABC. If the price is £35 at the time, and 100 stocks are available for this amount, your order would go through immediately at a price of £35 per stock.

You can also place an order when the exchange is closed. In this case, the order will be sent to the market upon reopening. Keep in mind that the price you receive the next day can be different than the price when you placed the order. For example, if positive news breaks overnight about ABC, the stock may resume trading the next morning at £40 per stock. In that case, with a market order you would then buy £4.000 of the stock the following morning. Of course, you can still remove the order before the market reopens the next morning.

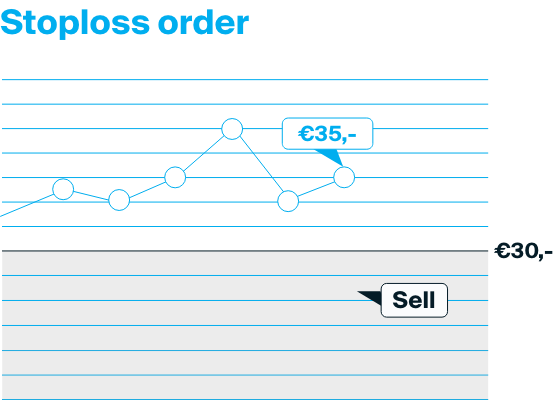

Stoploss order

There are also order types that can be used to respond to changes in the market. For example, if you hold a position of 100 stocks in ABC and wish to protect yourself from a price decrease, you can place a stoploss order. Say the price is currently £35 per stock and you wish to sell the position if price drops. You can then place a stoploss order with a stopprice of £30. That way, if the price falls to £30 or below, your order will then be sent to the exchange as a market order. This order type is handy if you are unable to monitor the market at all times.

However, you should also consider that it is possible that your order will be executed for less than £30. Say bad news about ABC breaks outside of market hours, driving the open price to £20 the following morning. That would mean that your position would be sold as a market order at £20 per stock.

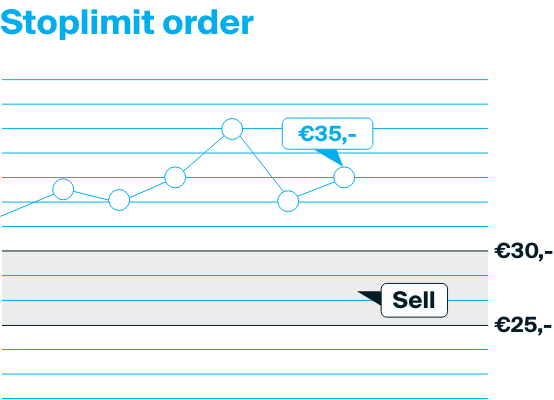

Stoplimit order

What if you believe that the sharp decrease from the previous example would eventually be corrected? Say you would like to sell if the stock price drops below £30, but receive at least £25 per stock from the sale. You can then place a stop limit order. If the price drops below the stop price of £30, this will trigger the order as a limit order with a minimum sell price of £25.

Order duration

In addition to the various order types, one final option to consider is the order duration. With a Day Order, your order is valid only on the current trading day. If the order is not executed by the end of the market day, it will expire and be removed from your account. Alternatively, you can place a Good ’til cancelled or GTC order which will leave the order open continuously.

Coming up

In the next lesson will discuss the building of your portfolio, and show how you can limiting risk.

Start investing today.

Start investing today.

- Incredibly low fees.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.